I worked with Founders, CEOs and funds to save 7 companies from bankruptcy. In B2B, Consumer, and Infrastructure, from Series A to post-IPO. Saving tens of thousands of jobs, generating $2B+ in cash, and rising again, stronger than ever.

As times will become very tough, if not life-threatening for most startups, here is a selection of very practical and quick restructuring solutions and tools we have used.

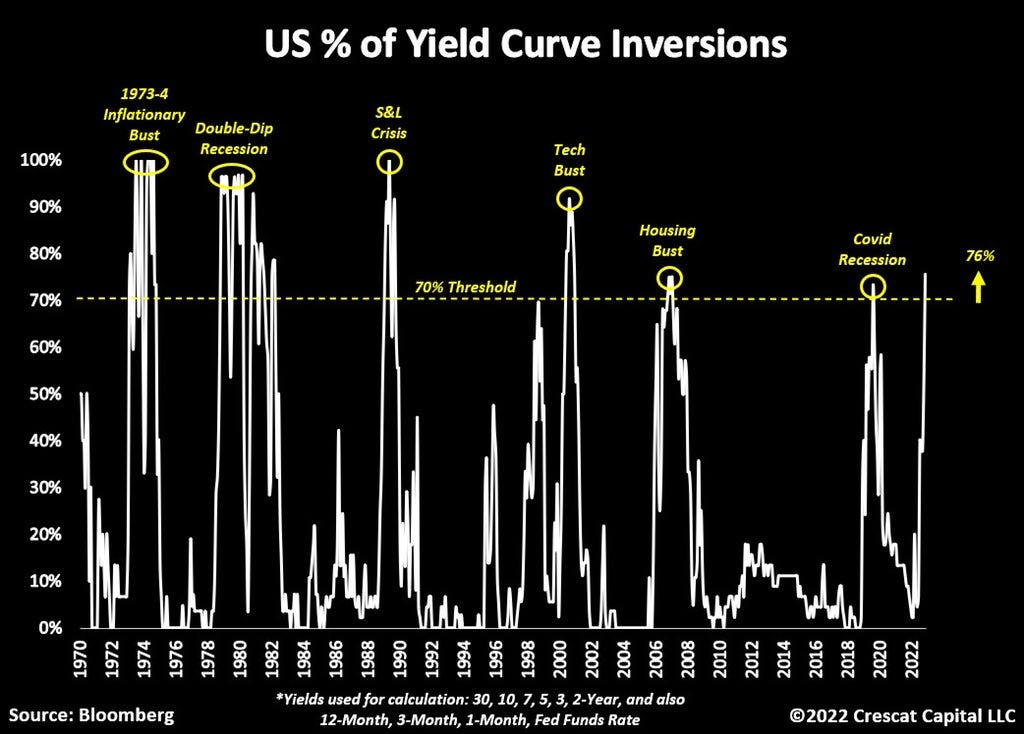

We are undeniably well engaged into a recession that will profoundly affect startups lifeblood: Revenue and Fundraising. Yes, it does feel very 2001.

There is no objective reason in sight why this downturn wouldn’t last at least as long as the shortest of the 6 previous ones: 2 years.

A big ice bucket which thermic shock will be amplified on an ecosystem that comes out of the most heated and excessive time in its history: hundreds of startups burning billions of dollars on broken economic models and bloated organizations, often in very crowded and each time narrower serviceable markets.

On the other hand, VCs still need at least a couple of quarters to fully evaluate how deep are their losses. Most still have 4-5 years to deploy their recently raised funds: really no need to rush writing new checks. Late stage valuations have plummeted, and structured terms are back.

There are only two reasons why startups die: Founders give up ; Run out of cash.

Any Founder should rush to secure at least 2 years of runway

and aim at becoming Net Cash Neutral meanwhile.

To achieve this outcome, many will need to do a profound restructuring well beyond layoffs, to fix their economic models, cleanse unhealthy customer bases and slash dangerously high operating costs. Hopefully this newsletter will help them get off to a strong start.

Your mission alone won’t keep your business alive. Only your bank account can.

The perfect time to act is now.

No brainers

Let’s quickly evacuate the two most obvious cases, no matter how many millions you still have in bank.

Case 1: Software startups who have not yet proven Product x Market Fit

Immediately scale back to a nimble and scrappy A-team that can fit in a We Work meeting room around the Founders. Scale down to a monthly burn in the tens of thousands of dollars until you firmly secure PMF.

💡 A dozen of your friends using your product doesn’t prove PMF anymore. Case 2: Series B+ with indisputable PMF, but no proven economic model

No matter how massive is your user base and MoM growth, you need to acknowledge your company is on slow-death mode and interiorize that survival is a pre-condition to growth. In his own way, Elon is currently applying the playbook to Twitter:

Scale back drastically, ideally the closest to your Series A size and cost base

Protect your core: engineering and science

Founders must go back in the trenches and own back the direct leadership on: product development, engineering, monetization and hiring

Stop spending on acquisition. Rather focus on user retention and engagement

Multiply monetization iterations to find how to make your cash register ring

Diversify your insight / input providers as you brainstorm on how to make money

Make sure all your teammates are on the same new page. Get rid of misbelievers and road-blockers in no time

💡 Have you even straightly asked your users: what would you be ready to pay for? Stop the bleeding!

There is no such thing as ‘fixed’ costs. Full stop.

Proof is, if your company liquidates, all costs go down to zero. So have no taboos, consider everything being up for cuts or renegotiation.

The most common mistake is to rush to the conclusion: payroll being our biggest operating cost, let’s layoff and we’ll be fine. Layoffs are most probably unavoidable, and we’ll get to them in the next chapter.

You should start with the faster and easier actions:

Lock your bank account: suspend all payment authorization rights but yours and your CFO’s

Suspend issuance of hiring offers

We are close to year-end: don’t promise any cash bonus yet

Freeze all payments that would not result in an outage: rent, non technical vendors, professional services, etc.

You’ll get back to them in a more discriminate way in a couple of weeks, once you have a clearer overall plan

Dedicate a street smart colleague to collect outstanding receivables. Consider paying her/him a success fee

Take a few hours to stitch the smaller wounds that have a big role in setting the new tone. Such as: stop ordering snacks, swags and perks, return those new MacBooks and iPhones, stop all subscriptions non critical to customer service, cancel furniture orders, etc.

Don’t plan nor debate too much. Just do it.

💡 If you have A-grade enterprise customers (or resellers), selling your invoices to Factoring is non-dilutive, cheaper and faster cash than raising funds. Doing it in a D2C allowed us to need only 3 raises before Exit, with Founders still owning 50% of the company.Then you need to spend more time on the deeper and more complex hemorrhages: cash destroying customers, products, territories, offices, etc.

Pricing

Pricing is the most powerful lever to improve your cash position in no time.

In my experience with startups, it is very over-looked, and I see teams spending a lot more time discussing rebates & discounts than prices. Too many startups under-price their value in the first place: lack of experience and knowledge, fear, priority to growth, etc.

Yet, the pricing math is extremely powerful: suppose your current price is $100, and your EBITDA margin is 5% (that is of revenue). Increasing your price by a mere 5% = 5$, results in … doubling your EBITDA.

Of course, price sensitivity can come into play, and you may lose some customers or experience a hike in plan downgrades. But more often than not, when startups I accompanied raised their real prices smartly (start by reducing discounts), benefits far outweigh the losses.

💡 Iterate to negotiate with your customers. Not amongst yourselves in closed rooms.Defaulting customers (B2B)

Sure, times are tough for everyone. But your responsibility is to save your company. Ultimately your options are: they pay, or they downgrade and pay, or you suspend / stop service.

Some of them are big companies defaulting on big amounts and not returning your calls? Send success-fee based collection firms after them.

The defaulting customer is also your vendor? Stop paying in return. Consider bartering.

Free Customers / Freemium models

You may not have enough time ahead to wait for the ‘Free’ to produce the ‘mium’.

Calculate their TCO (Total Cost of Ownership) and hang it on the wall: for them it’s free, for us they cost $$ per day

Estimate how many months do Free customers take to pay back for their total cash costs

Pay back in less than 12 - 18 months? Not bad. Still try to reduce the cost of serving them: lower/no customer support, deactivate features that grow AWS bills, automate product set-up, etc

Longer payback time? Shift some to ‘paid’ (even to a symbolic fee), get rid of some. If you can’t honestly see through the economic advantage of the free plan altogether depending on how big is their cash drain.

‘Free’ is and will remain seminal to SaaS, Gaming, etc. You need to be well aware that more than ever, nothing will be given ‘free’ to you. And more likely than not, massive growth of non-paid customers won’t impress VCs as much. So make sure you calibrate ‘free’ as tight as necessary for your 2 years runway. You will always be able to reopen the tap once your runway is under control (or your competitors go out of business, allowing to charge a premium on other plans).

Paid customers

For the 20% of them draining 80% of the cash losses:

Think in terms of cash-payback time, taking full CAC into account (in SaaS, MRR is of no use for these circumstances)

Reprice as many as you can: price increase, reduce/stop existing discounts, change service level. You will be surprised that sometimes you may even grow your business with them

Some may have good value to provide in return: testimonials, referrals, social media posts, customer reference calls, etc

In entreprise, be careful with, but not shy of, those customer who strongly legitimize your product

Respectfully suspend those who are not worth it anymore

💡 For the 20% of your customers generating 200% of your cash, make sure they are getting the absolute best of you, and show a personalized token of gratitude (hand written letters cost nothing and can take relationships a long way). Now more than ever, you can’t afford losing any of them. Warning: if your paid customers are mostly startups, prepare for a roller coaster of defaults. You may consider:

Redirect your salesforce towards customers less dependent on external funding

If you are a critical application to them, offer discounts in exchange of non refundable upfront payments

Apply a significant customer default to your cash projections

Help them raise funds

💡 If they also are your vendor, stop paying them as well: it's a two-way street. Consider bartering.Some unit-economics tips

To make the right decisions you will need solid analytics. In particular:

Don’t stop at EBITDA: go further down to Net Cash

Forget averages. Analyze as segmented and granular as you can

In Entreprise, analyze each customer individually, allocating as many costs as you can (e: payroll of PMs and Engineers doing custom developments)

Fully charge your CAC, including Marketing & Sales total costs (eg: payroll, systems, paid prospect listings, etc). And even some of your own costs if you spent real time selling (especially for enterprise B2B)

Too often, costs that belong to COGS are wrongly allocated to other categories, resulting in overstated Gross Margin. Eg: customer set-up and support, cloud infrastructure, sub-stack applications, etc

Receivables: assume higher defaults coming. Try to identify and allocate Default % rates per customer segment

Compare your spreadsheet’s Net Cash with your bank accounts. If they differ: the bank account rules

Complexity cost

If you have multiple products, projects, initiatives, offices, countries, etc. apply the same cash-evaluation scrutiny.

Btw, if you are a pre-Series C B2B, and you sell more than 3 distinct products (not pricing plans or product declinations) to get business going, then something must be wrong somewhere.

If you scale down an office or a country more than 50%, you’ll probably be better off closing it altogether and serving the local customers differently.

I will never cease to be amazed at how most leaders, especially in bigger organizations, totally underestimate the ‘complexity cost’. Our innate passion for ‘more’ comes with a tremendous hidden cost - incremental workforce, meetings, space, systems, etc - just to be able to handle yet another product, yet another office, yet another country, etc. In my experience with bigger companies, a good 20% of overhead costs is driven by complexity.

I estimate equally as much is lost in missing opportunities. Because complexity is a daily drain on the scarcest and most valuable resource of all: Senior leadership time, energy and focus.

Prioritize aggressively. Then prioritize again.

💡 When you do a prioritization exercise, forget the ‘each one scores each project from 0 to 10’. Provide each participant with a finite amount of chips to allocate across the projects (or people, customers, etc.) you want to prioritize. Resources are finite: a prioritization exercise must reflect that.There would be a lot more to say in this chapter. I hope you already have something to start chewing on.

Ring and pinky fingers

Recent exuberant excesses have led too many startups to hire frantically, spiral-up cash compensations, out-bid each others on costly benefits and perks, and ultimately over-bloat their payroll (as also did many VCs).

Yet, too many Founders I speak to are convinced they already have zero fat, and are as lean as possible. When at least 175,000 Tech workers have already been laid off, is your productivity level, or revenue potential, so much stronger than all these companies to make you immune to layoffs?

OK, then please consider this little analogy.

You surely love each of your 10 fingers. They all are your fingers. Each has a really strong reason to be where it is. One even carries your precious wedding ring.

Truth is they are absolutely not equally important. Thumbs and indexes do 80% of the job. Pareto is everywhere. In other words, if you returned from climbing Everest having lost your index, ring and pinky finger to the frost, 6 out of 10, there wouldn't be anything fundamental you couldn’t do anymore.

If your cash balance and activity traction urge you to prepare for a harsh winter, laying off less than 20% of your workforce (employees + contractors), ‘just’ your pinky fingers, has a very high chance of being insufficient. Remember, more likely than not, fundraising is not waiting for you as it used to.

Here are a few proven practical approaches:

Protect and cherish your gold diggers: your best engineers and scientists, your stellar sales people, the best customer retainers.

Consider reallocating to them some of the cash and unvested stock-options you are getting back from your layoffs.

You have no objective performance ratings available for decision?

Use the fingers analogy, and force-categorize everybody as 40% of thumbs and indexes, 20% middle, 20% ring, and 20% pinky fingers.

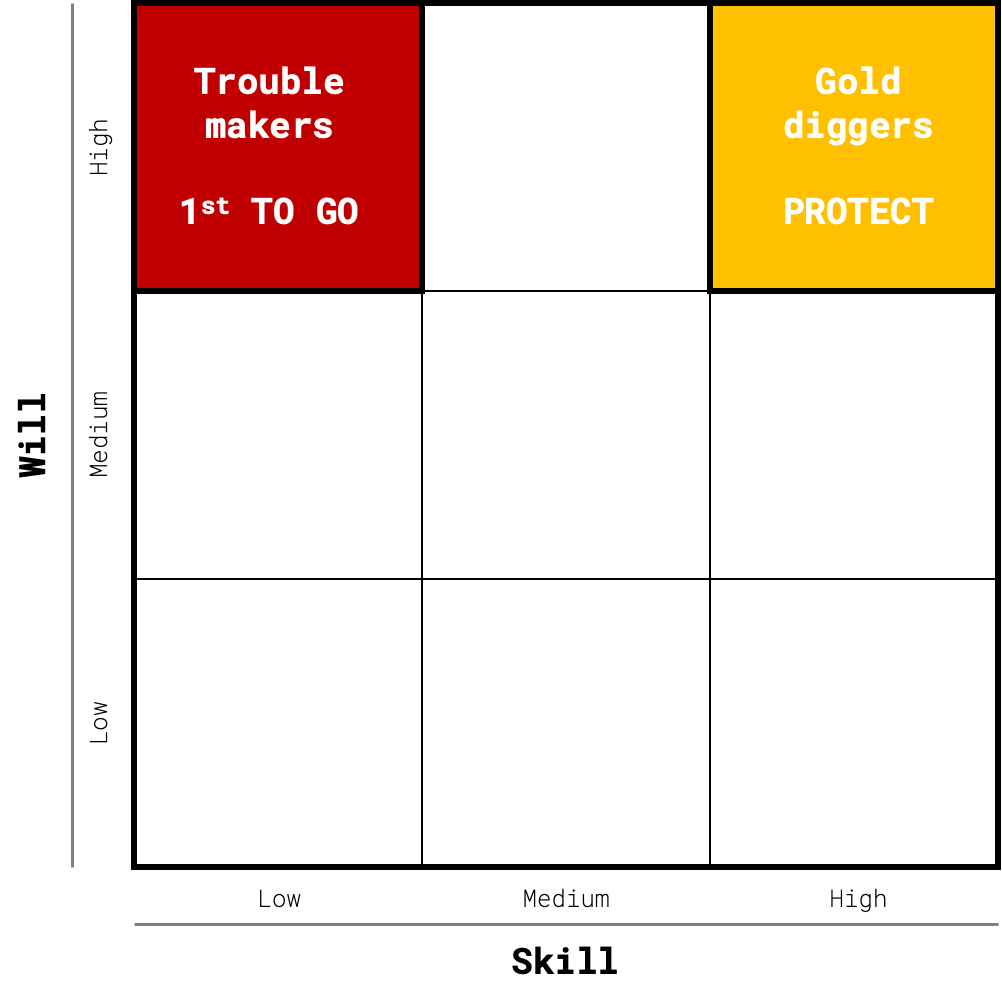

Classify everybody in a Skill x Will matrix. Let go all the Low Skill x High Will: they create more damage and entropy

People with ‘Admin’ in their titles are frequently strong candidates to be let go

The past two years created a new type of hype: PMs. Until the Tech Giants (eg: Google, Meta, etc) made PMs the ‘new normal’ of how to get any product functionally built and delivered, down to the tiniest button, startups used to do just fine with no PMs. Chances are very high you could do with less (no?) PMs. Also an excellent forcing device to kill some of your internal bureaucracy.

Cut all ‘necks’: any position who is between one superior and 1 or more direct reports.

Shift sales compensation to mostly variable pay. In one of my startups, the Head of Sales was paid an uncapped 10% of sales, but $0 fixed salary.

Labor market is in your favor: renegotiate compensations, starting with the B players. Whoever leaves will not be hard to replace.

Founders who managed to be relatively less diluted thanks to recent sky-high valuations: carve-out a portion of your own equity to compensate your pivotal talents or new hires

Make sure you calibrate your layoffs in payroll $ value, not just headcount

Assume anything you’ll do or write can end up on the front pages

Layoffs are disgusting for everybody. Multiple waves are not OK. Be courageous and sensible: any additional wave further depresses your team and worries your customers. And, at least a few thousands of the 175,000 laid off are surely better and cheaper than your bottom 20% performers. Probably more hungry too.

💡 I kept my sleep through the multiple layoffs I orchestrated only because I kept laser-focus on the many more jobs we were saving, and those we would soon be able to create again.Mokita

The truth we all know but agree not to talk about - Mokita, in New Guinean

Now that I hopefully fed your natural craving for very practical and actionable actions (more coming thereafter), we need to take a step back.

Any company has Mokitas. If you are about to restructure yours and steward it through these risky, ambiguous and unpredictable times, you must surface yours.

With what happened in the past 2-3 years, it’s likely many companies may surface Mokitas such as:

We raised a ‘hot’ Series A, but have not proven PMF

Our uniqueness is more in our narrative than in our product

We are building a feature, not a product

We have no clue how to get solid unit economics

We have built a high-pay 9-to-5 spoiled culture (btw, ‘Startups are hard’ is not meant to be true only for Founders)

Our top performers will quit as soon as they find another job

💡 Exercises to surface and handle Mokitas - i.e: hard truths - are broadly available online. In my experience, they rarely achieve their full potential without external facilitation. It’s just very hard to be brutally honest about oneself and handle it correctly. Especially after having been glorified.Furthermore, not all companies are worth going through a painful restructuring. Restructuring is always painful and can’t fix fundamentally doomed companies. Unless you are sitting on a really big pile of cash that could allow you to restart any new business from a blank sheet, such brutal market correction calls every Founder to take a step back and come up with an ice-cold answer to an equally ice-cold question:

Putting passion and fears aside, and no matter how much I love our mission and team:

Why is our business truly worth being kept alive in the first place?

You are here looking for 1-2 powerful and economically healthy ‘engines’ to storm a really bad weather AND justify to continue build a business upon. Some illustrative examples:

80% of our customer have an 80+ NPS, their annual Churn is only 3% and each new such customer pays its CAC back in less than 12 months

Our Free user base is so massive and growing so fast, that charging $4.99 / month to only 10% of them should make us cash neutral

To break-even, we only need to convert 20% of our ‘strong interest’ customers in our pipeline, and reduce our overhead by 20%. Anything above is pure upside

Our Revenue per Employee is 3x the 2nd best and 5x our peers average: we are factually crushing it

Our past 6-months unit economics trend towards reaching positive net cash during our runway, while sustaining double digit MoM growth.

We are close to Nobel-prize level marketable discovery

None of these reasons qualify : We have this incredible mission ; We will be faster, cheaper, better ; Our product is awesome ; We’ve been great at raising funds ; and any other ‘soft’ and non economically foundational reason.

[The first] business of business is business - Milton Friedman, updated to 2022

Here is an industry wide ‘Mokita’: ‘Mission-driven’ has become an empty buzzword, often covering-up for very obvious business non-senses. If you chose to be the Founder of a company, rather than a non-profit, then no matter how consequential may your mission be, or not, you need to make sure you are building, or at least see a path towards, a real, profit making, business.

The good new is: it won’t be self-redefining, and certainly not shameful, to rewrite your mission, or pursue a new one altogether, if the current one dooms the business to financial death. It is indeed very possible the best restructuring you can do is to stop wasting your talent, energy and time on this company, and move on to the next one.

Reorganize

In my experience, many Founders of still relatively small companies (eg: under 1,000) over-complicate and over-think organization redesign. While they under-estimate the criticality of the ‘soft stuff’: leadership style, symbolic acts and words, culture, energy, communication, managing perceptions and emotions, etc.

I will here only highlight a few specifics to a restructuring phase:

The first rule of Change Management: Change THE Management.

In startups, the ability to self-change and adapt should be of the essence. In practice, it rarely works for every member of the Management. In doubt? Out!

Recent times have too often relegated non ‘Major Investors’ to 3rd class citizens kept in the dark: more than ever, secure the understanding and support of all your investors. Nobody ignored feels compelled to help.

Adopt best practices in staying in VCs’ radar even when you are not raising

If you are ‘dressing-up’ for an acquihire: layout (and keep internally secret) and do the costing of the smallest necessary organisation needed that the acquirer would find most appealing to acquire and absorb. It will increase your chances to make a deal.

Make also sure everyone has the same definition of ‘Focus’. As it designates the convergence of rays, from now on your concept of Organizational Focus should be like a car headlight that transfixes a deer in the night.

Over-manage your own, and your organization’s energy

Current times require chasing a different type of ‘Performance’, adding a serious dose of ‘Health’, and reflect this in new KPIs / Dashboards. Such as:

Bring ‘cash’ metrics forward. Examples:

Customer payback time (ideally under 18 months) is stronger than LTV

TTM (Trailing Twelve Months) is sounder than ARR

‘Paid revenue’ is more vital than ‘Revenue’

Months of runway is more to the point than ‘Burn’

Shift from tracking % to track $ (unless your salary is in % 🙂)

A-hires is more important than ‘just’ hires

Double-down on tracking discipline and focus (don’t have an Asana yet?)

Hours worked is the #1 driver of any worker’s output: use your right to monitor.

💡 Daily check your bank-account balance and transactions .A couple of communication tips

The second rule of Change Management: Repetition, repetition, repetition.

Capture your restructuring plan in a simple page:

Make sure to celebrate each completed ‘TO’, and the whole restructuring when done. It will have been hard on you and on all those who stayed. And, restructuring for survival is an (at least) equally critical milestone than a launch.

More than ever, you must picture to your team an energizing and inspiring future, with a clear and resounding answer to the legitimate ‘what’s in it for me?’. Again, this pain has to be worth it, for everybody who stays.

It is not the strongest of the species that survives, nor the most intelligent, but the one most adaptable to change - Charles Darwin

Invariably, the Founders who end up winning through such turbulent times are those who restructure fast and deep enough, further raise their bar, and build more strengths to capture the rebound. They will leverage the crisis as an opportunity to reinvent their mission, their economic model and goals, their leadership style and modus operandi, their concept and culture of performance. They will strive to strengthen their team and stay alert to seize strategic opportunities.

Software is far from finished eating the world. Science is blossoming again. Trillion dollar industries like Defense, Energy and Healthcare are barely starting to be disrupted. It still is an extraordinary time to build.

An A team that fits in one WeWork room for a software startup lacking Product x Market Fit would generate a monthly burn in the low hundreds of thousands of dollars? Oof